7 December 2023

The average Investment Trust (IT) is currently trading at a discount to net asset value (NAV) and the sector has been suffering from a relative lack of investor appetite. In this Briefing Note, we explore some of the reasons behind this and suggest why such discounts might present opportunities for certain investors.

Regulatory change may be on the horizon

The Investment Trust (IT) sector has witnessed sell-offs over the past year due to a combination of factors. Amongst these is the increase in interest rates, which has made bond and cash investments relatively more attractive. In addition, new rules introduced under FCA Consumer Duty reform have led to a renewed focus on the underlying cost of investment products. The nature of ITs makes them well-suited to assets that are higher in cost, such as private equity and infrastructure (discussed further below). The regulatory framework that ITs fall under has been argued to exacerbate this issue, with a requirement to report costs to underlying investors at multiple junctures.

A Private Member’s Bill promoting a change in regulatory rules for ITs has been discussed in the House of Lords and had its first reading on 22 November. The Bill seeks to remove ITs from the regulatory framework of the Alternative Investment Fund Managers Directive (AIFMD). ITs were classed as ‘Alternative Investment Funds’ (AIFs) in the wake of the Global Financial Crisis, as more stringent regulations were introduced in the EU. These regulations for AIFs were introduced on top of the pre-existing comprehensive legislative framework that applies to ITs as UK listed companies.

The proponents of the Bill argue that the current classification and attendant regulation leads to ‘double counting’ of costs. The share price of an IT already factors in its financials, including costs such as management fees, yet intermediaries and institutional investors must report the costs again to their clients in their own disclosures. It remains early days for the Bill. Yet, if it is passed and investment companies are no longer classed as AIFs, the duplication of cost reporting will be removed. While this will not necessarily bring the underlying cost to the investor down, it may aid in reviving positive sentiment toward ITs.

Is it ‘always darkest before the dawn’?

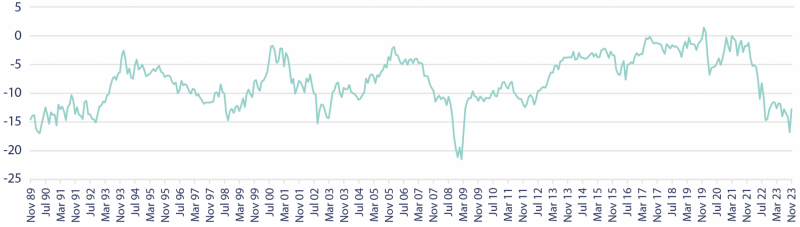

ITs are listed companies that trade on a stock exchange. They are collective investment schemes with a closed-end structure (a fixed number of shares) and can therefore trade at a price lower (discount) or higher (premium) than the net asset value (NAV) of the underlying assets. In response to the abovementioned sell-offs, the average discount to NAV has been climbing overall. October 2023 saw the widest month-end discount (16.9%) since December 2008 (17.7%), when markets were in the throes of the Global Financial Crisis. The IT universe discount has now narrowed to -12.8% as at the end of November 2023.

UK Investment Trusts total market – discount (%)

All data is provided by Numis and Refinitiv and is comprised of discrete monthly periods from November 1989 to November 2023.

The wide discount is being interpreted as an attractive investment opportunity by some analysts and market commentators who are adopting the view that it is ‘always darkest before the dawn’. However, others have cautioned against buying on discount alone without fully researching each Trust or without seeking expert advice.

Our own analysis indicates that a statistically significant relationship exists between the level of discount and future returns: historically, buying at larger discounts has improved minimum returns.1 This holds true over 1, 3, and 5-year time horizons. Intuitively, this makes sense since discounts tend to widen in times of uncertainty. Maximum return is broadly correlated with the widening of universe discounts. For the investor who maintains a medium to long-term time horizon and who feels comfortable with any attendant risks, we believe this could offer a potentially attractive entry point.

Shedding light on accuracy and opportunity

It is important to note that the sector has changed markedly over the past 30 years. Historically, the sector was full of closed-ended Trusts investing into equity and these vehicles competed with their open-ended peers. Discounts and premiums were easily calculated using the current share price of the IT compared against the weighted market price of the underlying securities. The composition of the sector has since altered, particularly with the rise of issuance from alternative asset classes. The latter can present complications when calculating the NAVs of Investment Trusts.

The closed-end structure of ITs suits illiquid investments such as private equity, renewable energy, and other infrastructure projects. The NAVs of these Trusts are calculated using a variety of methodologies, with updates reported typically every three or six months. It is here that we should take care: not only are there some occasions when discounts will reflect an old NAV, but models built on assumptions are only as strong as those assumptions. It is for this reason that some element of a discount may be warranted – market participants are uncertain about the accuracy of NAVs. When we recognise that 50% of the sector is represented by alternative investment strategies, the discounts begin to make more sense. However, that fears exist over the accuracy of NAVs does not necessarily mean that they are inaccurate. To the contrary, some operators in the space have been conducting asset sales either at net asset value or at a premium to it, supporting the case for accurate NAVs. These assets continue to trade at a discount, highlighting the disconnect between private and public markets.

Risks within the sector must be appreciated, including ambiguity over NAVs and the fact that past performance is not indicative of future returns. Yet, discounts to NAV at current levels arguably provide an attractive margin of safety for long-term investors. Not every IT is well managed and poised for long-term growth, however. This is where active management plays a key role in discerning the good from the bad. Cantab Asset Management has a track record of more than a decade in researching and selecting Investment Trusts.

Risk Warnings. This document has been prepared based on our understanding of current UK law and HM Revenue and Customs practice, both of which may be the subject of change in the future. The opinions expressed herein are those of Cantab Asset Management Ltd and should not be construed as investment advice. Cantab Asset Management Ltd is authorised and regulated by the Financial Conduct Authority. As with all equity-based and bond-based investments, the value and the income therefrom can fall as well as rise and you may not get back all the money that you invested. The value of overseas securities will be influenced by the exchange rate used to convert these to sterling. Investments in stocks and shares should therefore be viewed as a medium to long-term investment. Past performance is not a guide to the future. It is important to note that in selecting ESG investments, a screening out process has taken place which eliminates many investments potentially providing good financial returns. By reducing the universe of possible investments, the investment performance of ESG portfolios might be less than that potentially produced by selecting from the larger unscreened universe.