A year has now passed since the spread of Covid-19 became headline news and countries around the world started entering lockdowns. Few would have predicted the strength of the stock market rebound following the March 2020 crash. As the return path to normality starts to look clearer, questions remain around the longer term implications of the crisis. Governments are facing debt levels not seen since the 1960s, whilst economies continue to look fragile. Although some sectors of the equity markets continue to test record highs, others remain depressed, clouded by the uncertainty of what the recovery from Covid looks like. Media coverage has drawn significant numbers of retail investors into markets, sometimes with concerning effect. Questions around valuation and ‘bubble’ characteristics are being raised; at the same time, policymakers are grappling with rising unemployment and depressed growth. As we lose track of the number of times we have read or used the word ‘unprecedented’ over the last twelve months, we make every effort to step back, consider the full picture, and evolve client portfolios to target long-term growth.

This piece will cover four key topics:

- Rishi Sunak’s Budget

- Prospects for the UK

- Retail investor power and the rise of Cryptocurrencies

- Fiscal and Monetary support for Global growth

1. Rishi Sunak’s Budget

Much of the Budget had been announced ahead of time, leaving few surprises on the spending headlines. The future tax programme was less clear; we summarise the key points below:

Pandemic support has been expanded and extended:

- Furlough scheme extended until the end of September and an extra £13bn worth of support for the selfemployed through wider grants

- Weekly uplift in Universal Credit extended for six months, and Working Tax Credit claimants to receive a £500 one-off payment

- Business rates relief continued and lower VAT rate for hospitality to be maintained at 5% until September

- Stamp duty holiday extended until the end of June

- Extra support for the UK’s vaccination rollout

Infrastructure, the arts, sport, and green investment were areas of focus:

- A new national infrastructure bank to be established in Leeds with capital of £12bn

- Over £700m of recovery support for arts venues and sport

- £15bn in green bonds to assist in the move towards net zero by 2050

- £1bn fund to promote regeneration in 45 English towns

Tax rises were outlined, with the Chancellor able to avoid breaking any of the Conservative election pledges:

- Corporation tax rate rising from 19% to 25% in 2023 on profits over £250,000, offset by a new ‘super-deduction’ aimed to boost business investment in 2021-22

- Income tax thresholds to be frozen at 2021 levels until 2025-6, a move expected to raise £8bn per year

- Inheritance tax thresholds, pension lifetime allowances and annual capital gains tax exemptions to be frozen at 2020-21 levels until 2025-26

2. Prospects for the UK

Since the Brexit Referendum in 2016, UK equities have underperformed their developed market peers. As the impact of Covid-19 and Brexit uncertainty on businesses weighed on investors’ thinking in 2020, UK equities continued to lag other markets. The Brexit deal on December 24 provided a boost to markets but this was not enough to regain the lost ground, with the MSCI UK ending the year -11.8%, some way off the MSCI World ex-UK return of +14.0%.

2020 performance was not symmetrical across the market cap spectrum. The internationally focussed UK large cap index posted a dismal return of -11.6% while the fully listed small cap index returned a more competitive +7.2% during the year. Against a backdrop of a weakening Sterling, few would have predicted the stellar performance of the Alternative Investment Market (‘AIM’) 100, up 20.6%. AIM, the more lightly regulated sub-market of the LSE, is 25 years old and after a challenging first twenty years is now home to leading and emerging global players in online retail, gaming and ‘big data’. ASOS, Fevertree and YouGov are just a few of the now 24 companies listed on the market worth in excess of £1bn, showing that the market has evolved considerably from its highly speculative and ‘blue sky’ roots.

Looking at the macroeconomic situation provides some insight into the UK’s underperformance last year. With a GDP shock of -9.9%, the economic contraction was the worst seen in 300 years. Although lockdowns left economies reeling across the globe, most developed economies fared better than the UK, with the EU and US contracting -6.8% and -3.2%, respectively. The furlough scheme in the UK has helped keep unemployment in check, with the jobless rate hitting 5.1% in December and an employment rate of 75% indicating 541,000 fewer people in employment compared to a year earlier. Public sector net debt now sits at over £2.1tn, 97.9% of GDP; tackling this debt burden will be a key element of the UK government’s Covid recovery plan.

Despite the challenges faced by the UK economy, there are many reasons to be positive. The UK is home to some of the world’s largest and most established companies. The country enjoys high levels of legal, political and regulatory stability, even relative to many developed market peers. Although large technology companies are primarily domiciled in the US and Asia, the UK has an exciting emerging technology and biomedical industry with potential for global leaders to emerge. This translates to the possibility of attractive M&A activity, particularly in the small-mid cap space. From a portfolio perspective, there is a relative abundance of exceptional active fund managers who have consistently and convincingly outperformed the UK indices. Overall, UK markets are trading at more normalised valuation levels than developed market peers. With the overhang of Brexit uncertainty now reduced and a period of political stability ahead, we have been adding to our UK exposure across the model portfolios having been significantly underweight the region since 2016.

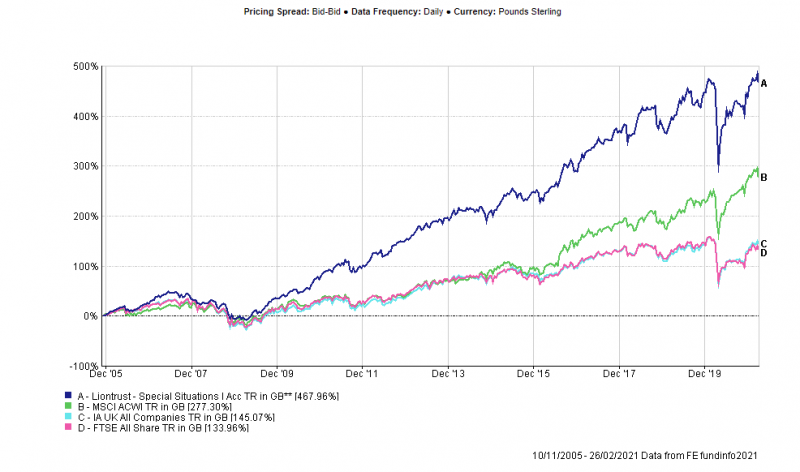

The importance of fund selection in the UK market can be demonstrated through the following case study. Liontrust Special Situations has been held in Cantab portfolios since shortly after the fund’s inception; when added, the total fund size was <£10m. Fifteen years later, the fund exceeds £5.5bn and has delivered an excess return for clients of well over three times the UK index, and nearly double the Global equity index.

3. Retail Investor power and the rise of Cryptocurrencies

The strong rebound in markets following the crash in March 2020 has attracted significant media attention, drawing retail investors into markets. Other factors undoubtedly contributed: time spent at home during lockdown; boredom; availability of trading channels; access to capital (for example due to the US government’s stimulus programme) to name a few. A small survey conducted by Yahoo Finance and The Harris Poll indicated that 28% of Americans bought one of the ‘viral’ stocks in January 2021, the most popular being Gamestop, AMC and Blackberry. The median investment amount was $150, but in some cases investors were committing much larger sums.

These dynamics are not limited to stocks targeted by ‘anti-Wall Street’ traders. In 2014, Goldman Sachs compiled an index of non-profitable technology stocks. From inception to January 2020, returns for this index were broadly zero, despite a wider market rally. Between mid-March 2020 and the end of January 2021, the index soared by 400%. Investment into these ‘emerging technology’ names could go well, if investors are able to identify future winners. More likely, in our view, is that the majority of this rise has been driven by speculative activity and is likely to end with significant losses for most participants.

A particular area of interest in this context is the meteoric rise in the price of Bitcoin. We examine below the drivers and risks associated with this market.

What is Cryptocurrency?

A cryptocurrency is a digital currency that uses blockchain technology – a database that stores data in blocks that are chained together across a network of computers. The use of the network of computers establishes a decentralised structure which exists outside of the control of any government or central bank. The data stored on blocks is irreversible; blocks cannot be deleted or edited, meaning all transactions are recorded permanently. Whilst there are thousands of cryptocurrencies in existence, the first and most prevalent blockchain-based cryptocurrency, founded in 2009, was Bitcoin.

There is a finite amount (21 million) of Bitcoin (BTC) in the world, and each bitcoin is ‘mined’ by a computer solving a challenging puzzle. Once the puzzle is solved, a new block is added to the blockchain and the miner is rewarded with a handful of Bitcoins. No one knows who invented Bitcoin; a paper was anonymously published to the domain bitcoin.org describing this new cashless payment system and mining commenced.

Bitcoin has a large list of advantages over traditional currencies: anonymity and privacy; no international transaction cost; its independence from financial institutions and its scarcity. However, it is not without its risks and ethical considerations. There is the price volatility; its association with the criminal underground and black-market activity; digital wallet scams; no refunds; and fraudulent coins.

There are two key factors that have led to Bitcoin’s stellar 2020 year: the accelerated transition to a digital world and the monetary stimulus being used by central banks around the world, most notably in the US. The Federal Reserve responded to the threat of coronavirus by cutting interest rates to zero and launching a $700 billion quantitative easing program, both of which tend to lead to a devaluation in currency. This threat, combined with increasing debt levels, has caused the value of assets, like Gold and Bitcoin, to surge in 2020 as investors look for an inflation hedge and a way to protect the value of their money. Additionally, as the US government continues to print money, the supply of Bitcoin is constrained. As well as there being a finite supply of Bitcoins in the world, the reward for mining new blocks is halved once every 210,000 blocks – roughly every four years. This means that miners receive half the amount of Bitcoin for the same amount of work, limiting the supply; the latest ‘halving’ occurred in May 2020.

Exposure within Cantab portfolios

It is possible that Bitcoin and other Cryptocurrencies become ‘mainstream’ and relevant for consumers and investors around the world. However, with repeated warnings from regulators around the risks associated with these assets and the direct competition they pose to Central Banks, we are not comfortable exposing clients within our model portfolios at this time. Activity in these markets remains highly speculative; although there may be long-term trends at play, the volatility associated with being involved is too high for us to contemplate. Our discomfort around market dynamics adds to the questionable ethical position of Bitcoin, both in terms of criminal activity and environmental impact. We will leave this topic with a warning on viewing Elon Musk as a ‘legitimiser’ of Bitcoin. Over the last month, Musk’s tweets have contributed to an increase in the price of Cryptocurrency Dogecoin of nearly 1000%. Dogecoin was established in 2013 as a joke; there is no limit in the supply of this Cryptocurrency, making price moves such as this highly irregular. We cannot help but question how this will end.

4. Fiscal and Monetary support for Global growth

Monetary Response

Since we last wrote on the monetary environment in July 2020, Central Banks have maintained their universal ‘do whatever it takes’ stance to support economies.

The Federal Reserve (‘Fed’), after lowering rates by 150bps to 0-0.25% in March and initially providing up to $2.3tn in loans to support the flow of credit to households and businesses, continued to pursue an expansionary monetary policy throughout the second half of 2020. The Fed has been buying Treasury and agency securities (the Fed’s portfolio of securities held outright grew from $3.9tn to $6.6tn between March and December 2020), expanding overnight and term repos and implementing initiatives to support the flow of credit. The Fed has also lowered the rate it charges banks from its ‘discount window’ from 2.25% to 0.25% and has relaxed regulatory rules on capital and liquidity buffers to boost bank lending. Without being able to lower the Federal Funds rate any further, the Fed has issued Forward Guidance, with Fed Chairman Jay Powell reinforcing on 27 January 2021 that rates will remain low until ‘the economy reaches full employment and inflation is on track to exceed 2% for some time’, applying some downward pressure to long term rates. Many of the liquidity facilities the Fed is currently running have a review date of 31 March 2021. We will be watching closely to see how the Fed unwinds these liquidity measures and the impact that this unwinding has on the US economy going forward.

In Europe, the European Central Bank (‘ECB’) continues to rely on liquidity facilities and purchasing programmes such as the Pandemic Emergency Purchase Programme (‘PEPP’) and the Asset Purchase Programme (‘APP’) to support the recovery. On December 10, the ECB Governing Council extended the duration and scale of several monetary policy instruments, reflecting a weaker inflation outlook. This involved increasing the PEPP by €500bn to €1,850 billion and extending its duration to at least the end of March 2022; extending favourable terms for banks and increasing borrowing limits to June 2022; an extension of the April 2020 collateral easing measures to June 2022; and an offer of four additional pandemic emergency longer-term refinancing operations (PELTROs) to act as a liquidity backstop to the euro banking system.

In the UK, the Monetary Policy Committee (‘MPC’) decided on 4 February 2021 to leave both interest rates and quantitative easing unchanged at 0.1% and £895bn respectively, after asset purchases had been increased by £150bn in November 2020. The Bank of England (‘BOE’) continues to help firms, especially SMEs, bridge cashflow disruption through a 6 month extension of the Term Funding Scheme announced in December. The joint HM Treasury and BOE Corporate Financing Facility, alongside the Coronavirus Business Interruption Schemes, provides liquidity in the form of loans and guarantees available to businesses.

Fiscal Response

The fiscal response by governments continues to be expansionary. In the US, Donald Trump provided a parting gift near the end of his tenure in December 2020, signing a $877bn relief and funding bill aimed to enhance unemployment benefits, provide direct stimulus payments of $600 to individuals, and increase expenditure on testing and vaccinations. A further $1.9tn spending package, set out by President Joe Biden, was passed by the House of Representatives in February. The package seeks to tackle a series of key elements, with the largest set of spending going towards further direct payments ($422bn), funding for local governments ($350bn) and additional unemployment assistance ($246bn). There are also provisions to increase the national minimum wage to $15 by 2025, however this is heavily opposed by the Republicans and thus is not finalised yet.

In Europe, EU leaders have finalised the agreement of their recovery fund. The Next Generation EU (NGEU) recovery fund aims to provide €750bn of aid to help support businesses and boost climate change related spending. The funds will be split into grants (€390bn) and loans (€360bn), with the largest net beneficiaries of the fund set to be those hit the hardest (i.e., Italy, Spain and Eastern European countries).

In the UK, furlough schemes and grant provision support have been extended further. At the start of 2021, the Chancellor announced a £4.6bn additional support package for struggling UK companies, particularly for one-off “top-up” grants to retail, hospitality and leisure companies. Announced this week, as the UK sets to unwind their toughest pandemic restrictions, the Chancellor seeks to provide a further £5bn as part of a “restarting” grant scheme to help affected businesses.

In recent weeks, market focus has settled on the possibility of future inflation. We wrote at length about the drivers of inflation and its implications for investment priorities in July 2020 (Identifying Risks and Opportunities) and our thoughts on the topics have not changed substantially since then. We continue to believe that taking positions ‘against’ policymakers in this environment will ultimately be unattractive. Wealth creating assets and inflation-linked cashflows (for example through real infrastructure assets) therefore look more appealing than fixed income at the current time.

Investment Implications

There is much commentary highlighting ‘record’ valuations, extraordinary recoveries and bubble-like activity in markets currently. Undoubtedly, there are sectors in which rational thought and analysis appear to have been superseded by hyperbole and speculation. However, we do not believe that global equity markets in general are displaying the euphoric characteristics which generally accompany a bubble. Instead, we see very unusual levels of liquidity and support by Central Banks and governments as the likely driver of rising asset prices. Absent a wholesale withdrawal of this support, we do not see an obvious catalyst for a sustained correction, although in this environment, market volatility is likely.

Economic fundamentals have a long way to recover, and consumer behaviour over the course of the Covid recovery remains uncertain. Saving rates are currently high relative to history; as economies reopen, it is possible that we see a significant release of pent-up demand. Many of the more sensitive stocks within indices remain well below pre-Covid levels (despite recent strength), leaving space for further short-term gains. Long-term, we believe that Central Banks are likely to tolerate and even encourage systemically higher levels of inflation as the least painful way to reduce government debt burdens.

As ever, we encourage clients to retain reasonable time horizons when considering equity investments. The rollout of Covid vaccines gives us hope, economically and personally, that a return to normality is within reach. In considering client portfolios, our investment team will continue to endeavour to look past short-term noise and focus on the long-term trends and opportunities (digitalisation, demographics and ESG issues for example) shaping our world. We will not be drawn into speculative activity, instead remaining focussed on fundamental analysis. As always, our Investment Committee endeavours to be responsible in all investment decisions and seeks only to select investments which are in the best interests of clients. We are committed to the highest standards of research and insist on the same standards where external fund managers are recommended. The processes, policies and procedures of fund managers form a central part of our analysis of external managers and we will continue to assess potential investments across a wide range of quantitative and qualitative criteria.

Risk warnings

This document has been prepared based on our understanding of current UK law and HM Revenue and Customs practice, both of which may be the subject of change in the future. The opinions expressed herein are those of Cantab Asset Management Ltd and should not be construed as investment advice. Cantab Asset Management Ltd is authorised and regulated by the Financial Conduct Authority. As with all equity-based and bond-based investments, the value and the income therefrom can fall as well as rise and you may not get back all the money that you invested. The value of overseas securities will be influenced by the exchange rate used to convert these to sterling. Investments in stocks and shares should therefore be viewed as a medium to long-term investment. Past performance is not a guide to the future. It is important to note that in selecting ESG investments, a screening out process has taken place which eliminates many investments potentially providing good financial returns. By reducing the universe of possible investments, the investment performance of ESG portfolios might be less than that potentially produced by selecting from the larger unscreened universe.