Market corrections are more common than one might expect, occurring once every two years on average.1 Investing with a long-term mindset is therefore essential to avoid the pitfall of buying high and selling low.

Many of the investment management pioneers have built their reputations on holding for long periods and often criticise the publication of three-monthly earnings guidance, which they view as promoting an unhealthy focus on short-term profits. Short-termism, combined with the fear of missing out and hindsight bias can complicate investment decision making.

This paper analyses the real returns of commodities, gold, equity, gilts and index-linked gilts since 19922 to illustrate the importance of diversification and taking a long-term view when constructing multi-asset portfolios. The key findings from the analysis show that:

- Successfully ‘timing’ the market becomes more important to performance the less diversified portfolios are

- The probability of achieving a positive return from holding a single asset class increases with the duration of the holding period for most asset classes

- The probability of achieving a positive return from holding a diversified portfolio tends to increase as the level of diversification and duration of the holding period increases

- Investing in an equally weighted portfolio anytime since 1992 and holding it for 5 years would have provided a positive return

- Over longer holding periods, the change in the maximum gain potential significantly outweighs the maximum loss. Maximum loss tends to decrease as the level of diversification increases

Analysis

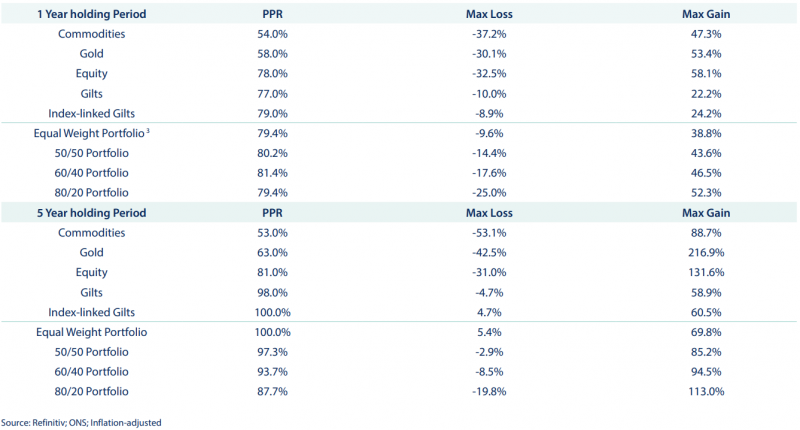

The table below outlines the probability of each asset class and portfolio variation achieving a positive return (PPR) if bought anytime since 1992 and held for one and five years respectively. It also shows the maximum gain that could have been achieved if timed perfectly and vice versa.

The Undiversified Portfolio

The false sense of confidence associated with hindsight bias occurs due to investors naturally assuming they would have bought at the right time. Successfully and consistently timing the market is extremely rare and some would argue impossible. As the tabulated results show, the probability of obtaining a positive return varies across asset classes for one- and five-year holding periods respectively.

However, the likelihood of achieving a positive return increases as the duration of the holding period increases. For example, the probability of obtaining a positive return for buying equities anytime since 1992 and holding them for one year is 78%. This probability increases to 81% if held for five years. The maximum gain for timing the market perfectly was found to be 58% over a one year holding period and 131% over five years.

In addition to equities, index-linked gilts were found to have the highest probability of producing a positive return if bought and held for any single year since 1992 at 79% and increases to 100% if held for five years. That said, fixed interest has had a significant bull run over the last two decades and might therefore not be an accurate representation going forward. This, of course, is the case for all asset classes with such substantial quantitative easing support from Central Governments.

Finally, the change in the maximum gain potential significantly outweighs the maximum loss over longer periods. The latter also tends to decrease as the level of diversification increases.

The Diversified Portfolio

Investing in an equally weighted portfolio anytime since 1992 and holding it for 5 years would have provided a positive return, with a max gain of 69.8% and a positive maximum ‘loss’ of 5.4%. The probability of a positive return decreases as the level of diversification decreases but, as one would expect, does elevate the maximum gain and maximum loss as the equity risk increases. Reducing the holding period to one year reduces the probability of a positive return, whilst elevating the maximum loss.

The Fundamentals of the Cantab Investment Process

This paper analysed the relationship between diversification and a long-term investment mindset and how this affects the probability of achieving a positive return. The findings illustrate the importance of diversification in a multi-asset portfolio and how longer investment horizons improve returns and reduce the likelihood of losses. This is central to the Cantab investment process alongside other key factors which is illustrated below:

Clarity, simplicity and transparency of investment decisions

Agnostic to investment style

No ‘black box’ structures

Taking a long-term view (5-years plus)

Appropriately diversified

Benchmark aware

1 Charles Schwab, Market corrections are more common than you might think, February 2022; 2 Bloomberg Commodity Index; Gold Bullion; MSCI World; UK CPI Index; 3 Refers to one third Equity, one third Alternatives (Gold and Commodities) and one third fixed interest (gilts and index-linked gilts). The 50/50, 60/40 and 80/20 portfolios refer to the equity allocation first with the remaining proportion equally split between the other 4 asset classes. Data as at 31 December 2021.

Risk warnings

This document has been prepared based on our understanding of current UK law and HM Revenue and Customs practice, both of which may be the subject of change in the future. The opinions expressed herein are those of Cantab Asset Management Ltd and should not be construed as investment advice. Cantab Asset Management Ltd is authorised and regulated by the Financial Conduct Authority. As with all equity-based and bond-based investments, the value and the income therefrom can fall as well as rise and you may not get back all the money that you invested. The value of overseas securities will be influenced by the exchange rate used to convert these to sterling. Investments in stocks and shares should therefore be viewed as a medium to long-term investment. Past performance is not a guide to the future. It is important to note that in selecting ESG investments, a screening out process has taken place which eliminates many investments potentially providing good financial returns. By reducing the universe of possible investments, the investment performance of ESG portfolios might be less than that potentially produced by selecting from the larger unscreened universe.