Over the last year, developed markets have seen the most rapid monetary tightening experienced in decades. The implications of this are, in our view, yet to be fully felt.

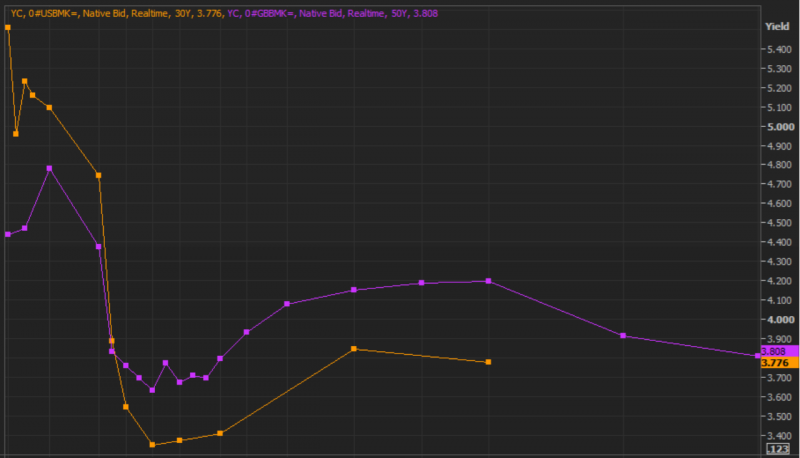

Bond markets are currently pricing a fall in interest rates within the next year – yield curves are sharply inverted. For this scenario to play out, inflation must drop rapidly and the real economy – particularly the labour market – must show signs of significant weakness. Without these signs, Central Banks will have no desire or capacity to loosen monetary conditions.

Equity markets on the other hand, have been buoyant. Corporate earnings remain resilient and investors have regained at least a degree of optimism coming off the autumn’s lows. In many areas of the market, prices indicate that investors do not see significant economic trouble ahead. In this scenario, it is difficult to see how inflation returns to or falls below target. A lack of recession, in our view, is consistent only with persistently above-trend inflation from this point.

The two scenarios priced by bond and equity markets are fundamentally incompatible. We cannot envisage a scenario in which both monetary conditions ease and macroeconomic fundamentals remain strong. We therefore see volatility ahead for equity and/or bond markets.

We remain unconvinced that governments – for their part – will push for a rapid return to low single digit inflation rates. It continues to be politically palatable to monetise pandemic-related (and legacy Financial Crisis) debt through higher levels of inflation in the short-term. Domestic demand remains strong across the US, UK and European economies, with labour markets tight. Higher and rising interest rates should tackle this part of the equation; ultimately tighter credit conditions have started and will continue to cross over to the real economy.

Beyond short-term considerations, we believe that there are medium to long-term inflationary considerations faced by developed economies which will need to be addressed by policymakers.

1. Geopolitical considerations

Conflict is inflationary. Physical conflict impacts supply and pushes prices up. But more subtle forms of conflict can also be inflationary. We are emerging from decades of relative geopolitical calm and globalisation of capital and labour. Companies have been able to look globally for cheap labour, supply chains spanning countries and continents have been resilient and barriers to trade have, for the most part, been declining. Ultimately, the impact of these forces has been to reduce corporate cost bases and provide tailwinds for lower prices and/or improving profitability.

These trends cannot remain favourable indefinitely. Once an American company has moved its production and/or labour force to the cheapest viable region, it cannot do so again. Indeed, it may be that some of the benefits accrued will begin to reverse. Focus on supply chain resilience is likely to imply a higher cost base, not just a static one.

2. Net zero transition

Investment in renewable alternatives to fossil fuels requires significant fiscal stimulus as well as resulting in direct increases in demand for scarce resources. Notably, copper, silicon, aluminium, lithium and cobalt are all required in increasing quantities. 2022 provided us with a taste of supply side driven energy market volatility. Whilst we hope that the dynamics of transition are less disorderly, we consider such a dramatic supply side shift to have potentially significant inflationary consequences.

Governments have seen the impact of direct fiscal action through the pandemic. Economic impact and furlough payments were highly effective in providing liquidity to consumers. We anticipate renewed enthusiasm for fiscal tools in meeting policy aims going forward, as has already been demonstrated with President Biden’s Inflation Reduction Act.

3. Improvements in productivity driven by technological advancement

A potentially deflationary force comes in the form of continued technological advancement, particularly in the area of artificial intelligence (‘AI’). Possible improvements in efficiency across a wide range of sectors and industry are easy to envisage. Higher quality training options, a reduction in manual and repeatable processes and lower labour costs would all have significant implications for wealth creation and the inflationary environment.

It remains early to select the ‘winners’ in investment terms from such developments, but we expect the impact of these technologies to be felt increasingly across the regions that we cover.

Conclusion

Assessing short term macroeconomic developments remains challenging. It is clear to us that Western economies remain some way from clear of the inflationary pressure which has prompted Central Bank action thus far. The continued tightness of labour markets and entrenched government interest in persistent inflation suggests to us that the current tightening cycle may have further to run. This would likely present difficulty for equity markets in the short run. Bonds would also be impacted, but hopefully to a lesser degree than we saw in 2022.

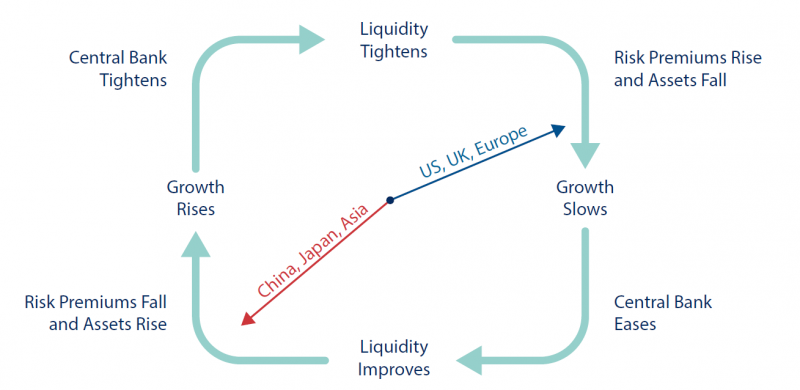

Liquidity Cycle

i.e., cash to assets; assets to cash

Source: Bridgewater Associates

Geographic diversification remains key in providing opportunities for upside in this environment. Asian economies, particularly Japan, are at the opposite end of the cycle from the US, UK and Europe. We believe that the potential for equity market returns in these markets remains attractive and retain our portfolios’ overweight positioning despite recent currency, geopolitical and pandemic-related underperformance.

Timing the liquidity cycle will always be difficult. But we must bear in mind that the pressures and forces at play are not new or unique. We have been through these environments before and come out the other side and will do so again. We believe that the portfolios are well positioned to be resilient in the face of potential further weakness, whilst also retaining exposure to those areas that we believe will provide attractive returns for clients across the cycle.

Risk warnings

This document has been prepared based on our understanding of current UK law and HM Revenue and Customs practice, both of which may be the subject of change in the future. The opinions expressed herein are those of Cantab Asset Management Ltd and should not be construed as investment advice. Cantab Asset Management Ltd is authorised and regulated by the Financial Conduct Authority. As with all equity-based and bond-based investments, the value and the income therefrom can fall as well as rise and you may not get back all the money that you invested. The value of overseas securities will be influenced by the exchange rate used to convert these to sterling. Investments in stocks and shares should therefore be viewed as a medium to long-term investment. Past performance is not a guide to the future. It is important to note that in selecting ESG investments, a screening out process has taken place which eliminates many investments potentially providing good financial returns. By reducing the universe of possible investments, the investment performance of ESG portfolios might be less than that potentially produced by selecting from the larger unscreened universe.